By Nik Aamlid

Wealth Advisor, CAP®

January 24, 2022 —

The Roth IRA may be the market’s most powerful retirement tool.

Sadly, recent studies show that only 10% of American taxpayers own Roth IRAs, per the Tax Policy Center. There are many types of IRAs and retirement plans out there, but today we’d like to narrow our focus and talk about the power of the almighty Roth.

What makes a Roth IRA so powerful?

The answer is simple: tax-free growth.

If you take nothing else from this entire blog, know this: money invested in your Roth IRA grows tax-free.

But if you’re reading this blog to learn more about the mechanics of Roths, as well as how to get started with one, I want to quench that thirst.

Albert Einstein once said, “Compound interest is the eighth wonder of the world.”

A Roth IRA harnesses that power Einstein identified, all without Uncle Sam’s share diminishing your return.

So, how did this magical investing tool come to be? And how can you take advantage?

Let’s take a little walk down history lane.

If you take nothing else from this entire blog, know this: money invested in your Roth IRA grows tax-free.

History of the Roth IRA

The Roth IRA is not your typical Gen-Z “Zoomer.” Despite being born relatively recently in 1997, it acts much older than its age.

The program was enacted as part of the Taxpayer Relief Act of 1997, an effort to reform the federal tax structure in the United States. After receiving bipartisan support in both the House and the Senate, the bill was signed into law by President Bill Clinton on August 5, 1997, along with his Balanced Budget Act of 1997.

The Roth IRA is named after William Roth, the bill’s primary legislative sponsor.

Roth was a politician from Delaware who served in the House from 1967 to 1970, then again as a Senator from 1971 to 2001. Roth passed away in 2003, but part of his legacy lives on through this investment vehicle used by millions of Americans some two and a half decades later.

The idea of helping American families leverage the growth of the market was not a novel one. In fact, the original idea was for an “IRA Plus,” an idea proposed in 1989 by both Roth and Senator Bob Packwood of Oregon. It took another eight years to get it passed.

“I wanted to make these IRAs available to many, many people,” Roth said of his legacy bill once passed. “Life is not getting cheaper for millions of American families, so it’s only fair to let them keep more of their hard-earned money.”

In today’s times of 40-year inflation records, this sentiment rings particularly true in 2022.

5 Reasons to Start and Keep a Roth IRA

While the history of the Roth IRA has been relatively brief, the impact has already been significant.

Let’s explore this impact with “5 Reasons to Start and Keep a Roth IRA.”

[This blog aims to be informational, but for comprehensive advice and strategy, we strongly suggest discussing these matters with a professional at Pinnacle Wealth. It’s easy to contact our team here.]

Reason #1: Tax-Free Growth And Withdrawals

This is obviously the primary benefit of a Roth IRA: the tax-free growth.

How sweet it is once you’ve hit age 59.5 to pay yourself without income taxes!

(An aside: As a financial planner, I think turning 59.5 should be celebrated the same way as other landmark birthdays are. Throw that 59.5 party!)

As you make contributions and grow your Roth IRA balance, that vested money grows uninhibited by tax. In other investment plans, you pay a capital gains tax on the growth. Either that, or you pay tax on the income derived from the investment.

This is not the case with the Roth IRA.

Now, there is a slight caveat to be made here.

There are many retirement contributions that enjoy a tax deduction, but the Roth IRA is not one of them. All money that is deposited via a Roth is made with post-tax earnings. Since the tax is paid upfront, investors are able to enjoy the gains without penalty or tax.

Apart from the tax-free growth, investors are also able to withdraw any Roth contributions (your principal) for qualified expenses without incurring penalties.

In simple terms, the money you put in, you can take out — without penalty. You just can’t touch that growth.

Here’s a brief, but not comprehensive, list of qualified expenses associated with penalty-free withdrawal (prior to the age of 59.5):

- Buying, building, or rebuilding your first home

- Qualified education expenses

- Unreimbursed medical bills

- Health insurance premiums while you’re unemployed

- Disability

- Childbirth or adoption expenses

You can research these issues more in-depth on irs.gov.

Now, these benefits don’t come without a catch…

Reason #2: Limits

This reason could be a deterrent for some, but for others, it should spark a sense of urgency. There are limits to how a Roth IRA functions.

The three fundamental limits to Roth IRAs are:

- You can invest only a certain amount each year.

- You can invest only until you reach a certain annual income.

- You cannot play catch-up if you start late.

Let’s take a more granular look at each.

You can invest only a certain amount each year.

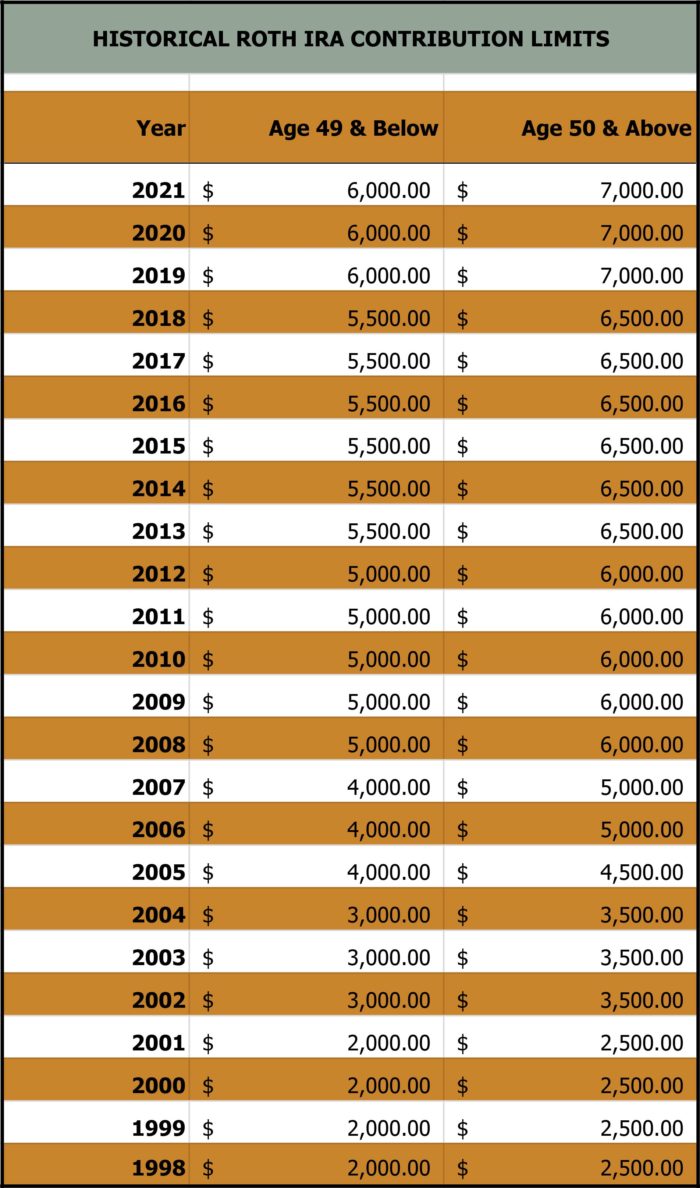

If you are younger than the age of 50, you are limited to $6,000 per year in annual contributions. This is typically referred to as “maxing out your Roth,” as you’ll hear in investing jargon. If you’re over the age of 50, the terms allow for a 20% increase in those contributions at $7,000 per year.

If you’re married, even better. Since these are individual retirement contributions, you and your spouse can each start your own.

That said, there are contribution limits. While they’ve increased in recent years, here is where the law stands historically on those limits:

Source: IRS, Financial Samurai

In this chart, you can see how critical it is to get started early and maximize your opportunity to grow a meaningful Roth portfolio.

Remember, we’re taking the route of the tortoise, not the hare.

But the limits don’t end there.

You can invest only until you reach a certain annual income.

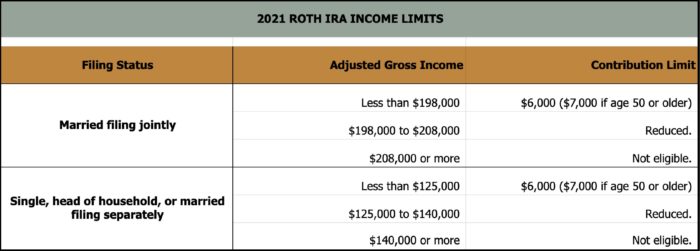

This may be the greatest factor in creating your urgency to invest. High-income earners are not able to use Roth IRAs in a conventional way.

As of 2021, the income limits were as follows:

Source: IRS.gov.

For a large majority of income earners, these limits may never come into play.

However, for high earners, or younger earners with earning potential in their futures, it’s critical to take advantage of Roths while you’re eligible.

There are backdoor opportunities, but we will save those for another blog.

The final limit revolves around catching up.

You cannot play catch-up if you start late.

There’s no, “Oh, I didn’t start until I was 45 years old; I’d like to really maximize this opportunity and play catch-up.”

Nope. Every year you miss is a missed opportunity to invest. It’s a limitation that causes us at Pinnacle Wealth to implore people to start as soon as financially viable.

Once you reach the age of 50, you’re able to increase your maximums nominally. But that doesn’t account for years missed.

As previously mentioned, there are other ways for you to use what’s called a “backdoor Roth,” or a “Roth conversion,” if you would like to convert non-Roth assets into Roth IRA accounts. However, we’re going to save that topic for another day. Stay tuned.

All stated, Roth IRAs come with built-in limitations, so start soon and invest often!

Reason #3: Ease of Use

Roth IRAs are quite easy to set up. (Contact us; we’d love to help!)

They are also quite easy to use.

We covered the majority of this under “qualified expenses associated with penalty-free withdrawal” above, but Roths don’t lock away your money with no path for usage.

Optimum use for a Roth is making your maximum contributions, then waiting until maturity of the account once you reach age 59.5. However, there is flexibility, which is an added, and delightful, benefit.

The only downfall to this ease is that if you decide to access these funds, there is no way to pay yourself back, or reimburse yourself for money withdrawn.

So before you withdraw, approach with caution.

That said, it’s a wonderfully easy safety net for future expenses.

Reason #4: Zero Required Distributions

While I hope I’m making a convincing argument for Roths, I’m not done yet.

Did you know that when using a Roth IRA, there is no required distribution schedule?

This means you can take out the money when you want it, after age 59.5, of course.

This is different from many other IRAs and retirement plans. Generally, withdrawals must start for IRAs, SEP IRAs, SIMPLE IRAs, or retirement plan accounts once they reach age 72 (or 70.5 if you reached 70.5 before January 1, 2020).

Roth IRAs are exempt from this.

That is, until after the death of the owner.

If you reach 59.5 and you’re still working (or you don’t need the Roth funds right away), you’re able to allow that money to sit and grow. Again, tax-free.

If you reach 72 and you’ve built in supplemental income in other areas, you again are not required to take the distributions; you can let them grow.

This level of autonomy gives investors unparalleled freedom and flexibility with their plans.

If you reach 59.5 and you’re still working (or you don’t need the Roth funds right away), you’re able to allow that money to sit and grow.

Again, tax-free.

Reason #5: Passing Money Down

Perhaps you’re exploring a Roth not for your own purposes, but to make a legacy impact on your family and causes close to your heart.

With a Roth IRA, you are setting up your heirs and those managing your estate with the most tax-advantaged vehicle possible. They are able to access the same tax-free withdrawals as you would.

This allows for more all around.

Drawdown Scenarios

Now that I’ve covered the benefits of a Roth IRA, let’s cross-compare benefits.

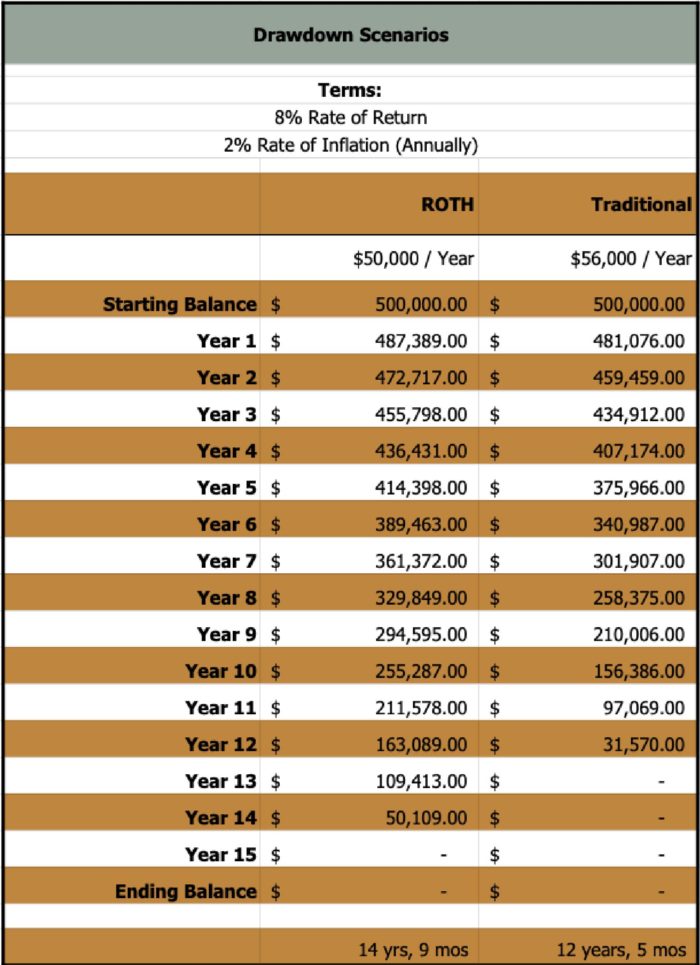

For this instance, I’d like to compare the Roth IRA versus a traditional IRA when it comes time to take retirement withdrawals. There are many more we could compare, but I know you don’t have all day to read.

Also, these are two of the most common retirement plans, so let’s line them up side-by-side for comparison.

The biggest difference here is, as you could probably guess, the tax.

With the traditional IRA, the money is taxed as “personal income” when withdrawn. When you withdraw $1,000, you must claim that as income and pay appropriate taxes.

The Roth is taken tax-free.

So, we drew up a hypothetical scenario where an individual:

- Has a $500,000 portfolio, and

- Would like to live off of $50,000 per year.

In order to net the full $50,000 with the traditional IRA plan, this individual would need to take out additional dollars to account for tax liability.

We estimated a 12% marginal tax rate, though we know everyone’s tax situation needs to be factored differently (which is why we suggest setting up a meeting to chat with one of our financial professionals).

This means with a traditional IRA, we should withdraw an estimated $56,000 to net the same $50,000.

Here’s how that pans out, mapped over a 15-year period, with no additional contributions made to either plan:

We were extremely conservative with the rate of return and inflation rates. And this chart is strictly an illustration. But as you can see, the scenario with the Roth lasts an additional two years, compared to a traditional plan.

There are other aspects to consider, such as the pre-tax income contributions (traditional) vs. post-tax income contributions (Roth), but neither of those make substantial differences in the illustration above.

I’m Convinced, What Are My Next Steps?

This is obviously a highly-nuanced conversation, far more than can be covered in a few blog words, but I hope I’ve conveyed the opportunity that exists with Roth IRA plans in 2022 and beyond.

Now, are Roths for everyone? Maybe not (but probably, yes).

However, are Roths an underused mechanism that can be leveraged for the vast majority of hard-working Americans? Yes.

When it comes to investing in a Roth IRA, we’d suggest you don’t start investing blindly. There is a sequential order to make sure you are maximizing your returns.

Our team would first and foremost make sure you are taking full advantage of any employer-matched investments. It’s hard to match a risk-free 100% return on your money!

There are other personal considerations to make. But after matching your employer’s contributions, we believe fully-funding your Roth IRA is an incredible vehicle for retirement.

I can speak on behalf of our entire team: we would be honored to have the opportunity to discuss this topic further with you.

Roth IRAs to the moon! (Am I doing that right?)

Thank you for reading.

This piece is not intended to provide specific legal, tax, or other professional advice. For a comprehensive review of your personal situation, always consult with a tax or legal advisor. Neither Cetera Advisor Networks LLC nor any of its representatives may give legal or tax advice.

Some IRAs have contribution limitations and tax consequences for early withdrawals. For complete details, consult your tax advisor or attorney. Distributions from traditional IRAss and employer sponsored retirement plans are taxed as ordinary income and, if taken prior to reaching age 59 ½, may be subject to an additional 10% IRS tax penalty. Converting from a traditional IRA to a Roth IRA is a taxable event. A Roth IRA offers tax free withdrawals on taxable contributions. To qualify for the tax-free and penalty-free withdrawal or earnings, a Roth IRA must be in place for at least five tax years, and the distribution must take place after age 59 ½ or due to death, disability, or a first time home purchase (up to a $10,000 lifetime maximum). Depending on state law, Roth IRA distributions may be subject to state taxes.