Managing the flow of your cash is a pillar in the Parthenon of financial success.

(And in case it needs to be said, cash here does not just refer to the number of “Andrew Jackson’s sitting in your wallet. This is every debit and credit hitting your bank account.)

Why is it so important to manage your cash?

Let’s consider an unfortunate and frequent situation.

A couple in their mid-30s makes $80,000 in combined household income, annually. They live on $70,000. They have done a great job investing for their mid- to long-term goals — every dollar left over is placed in an IRA.

So far, so good.

The problem arrives when we examine their cash flow statements (i.e., their checking and savings accounts). They maintain a balance of $5,000 in their checking account, which is sufficient, but fail to utilize an interest-bearing, liquid account to house their savings — the “rainy day” fund, if you will.

Unfortunately, rainy days are a given in life, and our young couple are no escape artists. A flood greets the homeowners and departs with a $10,000 bill, rendering the couple short of cash. A credit card emptily promises to cover the charges. The couple thinks they can pay the debt in a few months, but the high interest charges from their creditor quickly catch up to them.

Before they know it, the debt has delayed the couple’s investing plan by several (very expensive) years when considering the couple’s long retirement horizon.

And all of this could have been avoided with better cash management.

So, how can you better manage your household’s cash situation?

Let’s walk through our most frequently asked questions on the topic.

What are the risks of carrying too little or too much cash?

It may seem like there’s no amount too little to keep in the bank, but there are risks to carrying both a deficit and a surplus.

We’ve already touched on the risks of running a deficit in our example with the young couple.

But to understand how a surplus can harm your financial outlook, we have to look at a concept known as the time value of money.

In simplest terms, the time value of money suggests that a dollar today is worth more than a dollar tomorrow due to the dollar’s earnings potential.

Just think, if I gave you a dollar today, you could wisely position the dollar in an investment that potentially earns a higher rate of return — say 8% annually. An 8% annual rate of return would mean that the dollar would double in value in 9 years.

That’s a whole lot better than receiving the same dollar 9 years from now.

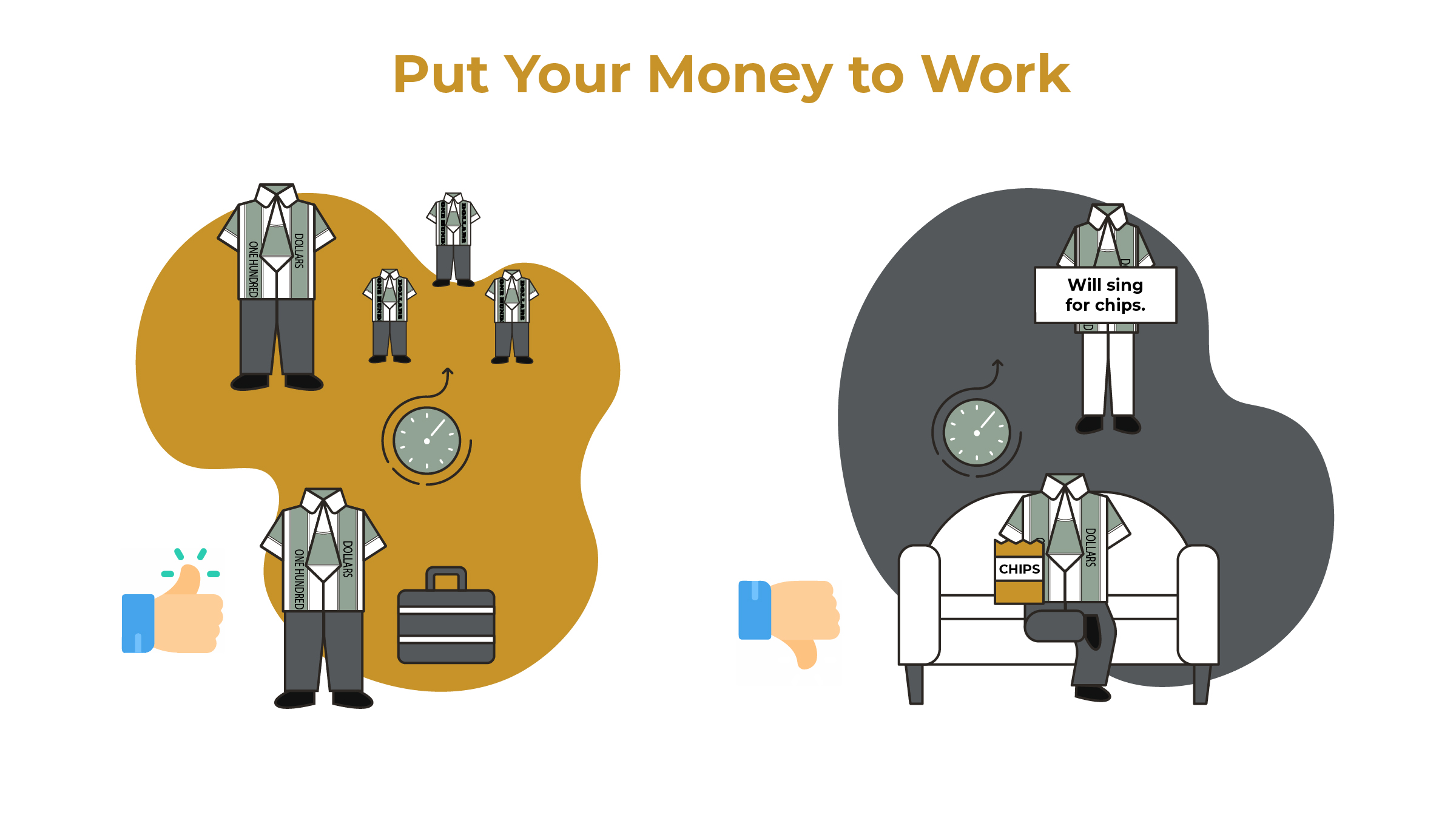

There are really only three ways to legally gain access to money:

1. Charity

2. You at work

3. Your money at work

By keeping too much cash in your checking or savings account, those dollars are unable to work for you and compound their value. This cost of foregone potential profits is known as opportunity cost.

Avoiding these risks of carrying too little or too much money in your checking and savings accounts will help you maximize your wealth while responsibly planning for rainy days.

How much should I keep in my checking account?

Because your checking account has no to very low earning potential, you only want to keep a slight excess above your monthly budgeted expenses.

So, if you spend $5,000 per month on living expenses (e.g., a home mortgage payment, groceries, entertainment, etc.), we would recommend maintaining a balance of approximately $7,000 in your checking account.

This slight excess above normal expenditures ensures that your regular bills are paid and can help protect you from unintentionally over-drafting your account.

How much should I keep in my savings account?

Savings accounts are a good place to house your emergency reserves, which are crucial to wise financial planning.

We generally recommend people reserve 6 months’ worth of living expenses in an emergency fund.

However, not all of those savings need to be stored in a highly liquid, short-term account such as a savings or money market account, which are currently at historically low yields (the national average is 0.04% — yikes).

Our optimal emergency reserve breakdown has 2 months’ worth of expenses in a savings or money market account and about 4 months’ worth of expenses in a conservative portfolio of lower-risk investments. These investments are slightly less liquid and marginally riskier than a savings account, but should lift your overall rate of return with these emergency dollars.

The important point to retain is that your emergency reserves should aim for stable liquidity, not higher returns.

I admit that it is hard to look at a savings account earning 0.04% interest and not dream of the earnings those dollars could potentially enjoy elsewhere.

It is true that inflation is likely eating away at these dollars’ purchasing power over time, but one has to consider the alternative: Keeping emergency funds in a volatile, liquid asset class like stocks may dictate a scenario where you have to sell at a low point in the economy.

Recovering from a poorly-timed sale of stocks is much more difficult than bearing the opportunity cost of having not invested there to begin with.

In sum, I encourage you to remember the theme of our topic: We believe you should hold enough (but just enough) cash for the bills and rainy days.

That is:

● Checking Account: Slightly more than one month’s expenses.

● Savings Account: 6 months of expenses:

○ 2 months in a savings account.

○ 4 months in a conservative portfolio of investments.

So, sit down with your budget, a calculator, and your bank account tab opened and figure out what those numbers are for your financial situation. Doing so can help protect you from both financial strain and its counterpart, going broke slowly.